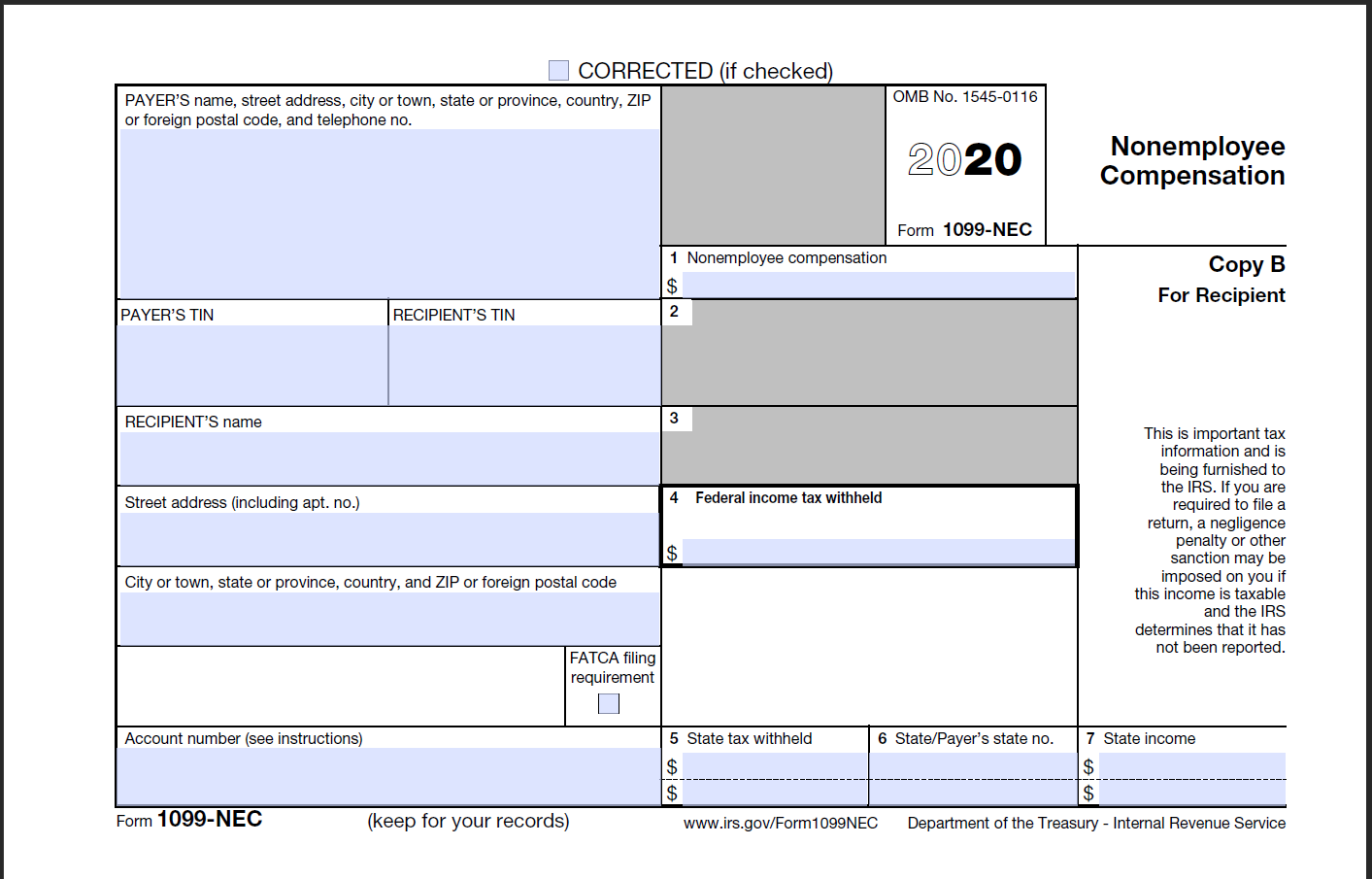

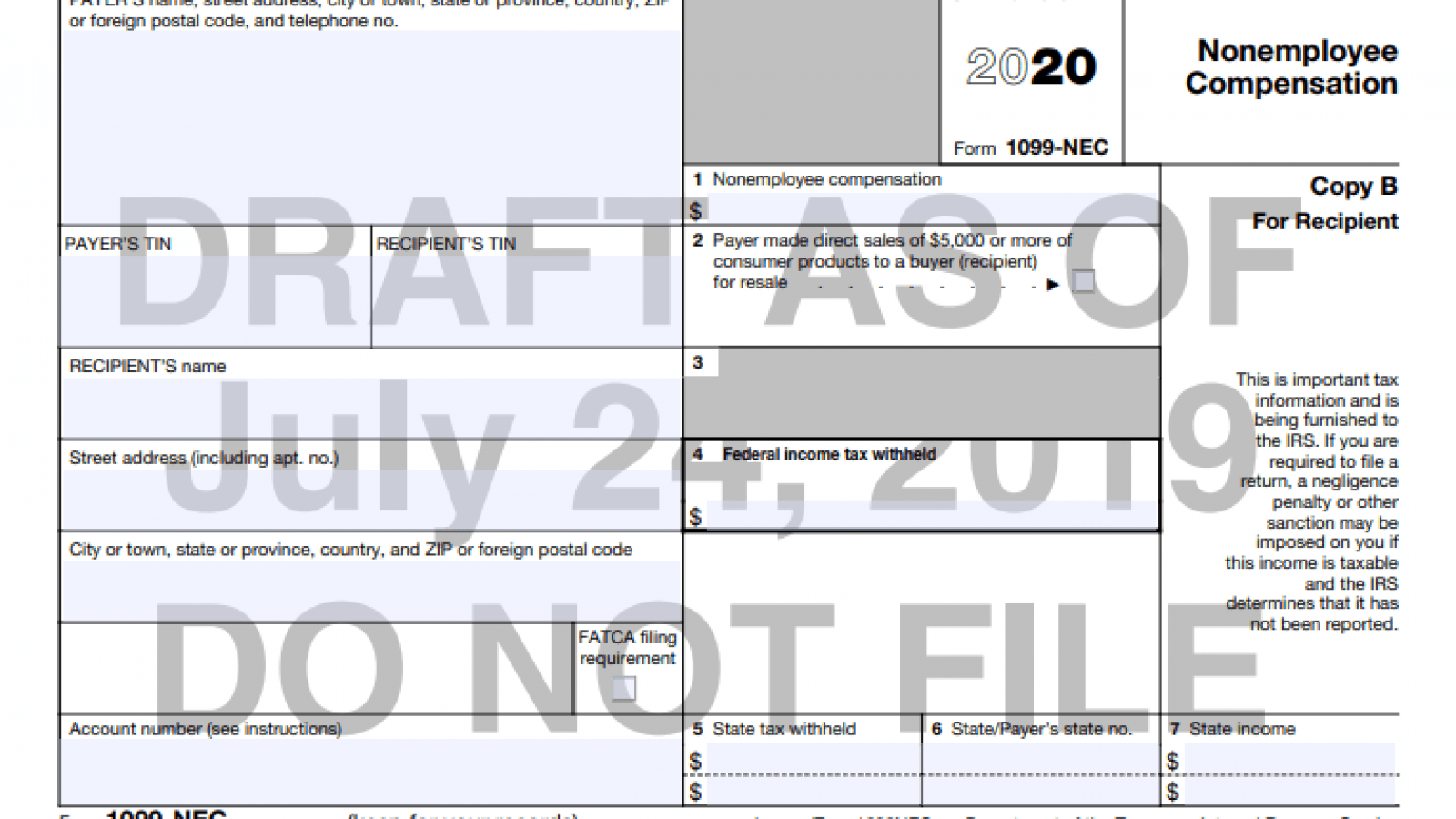

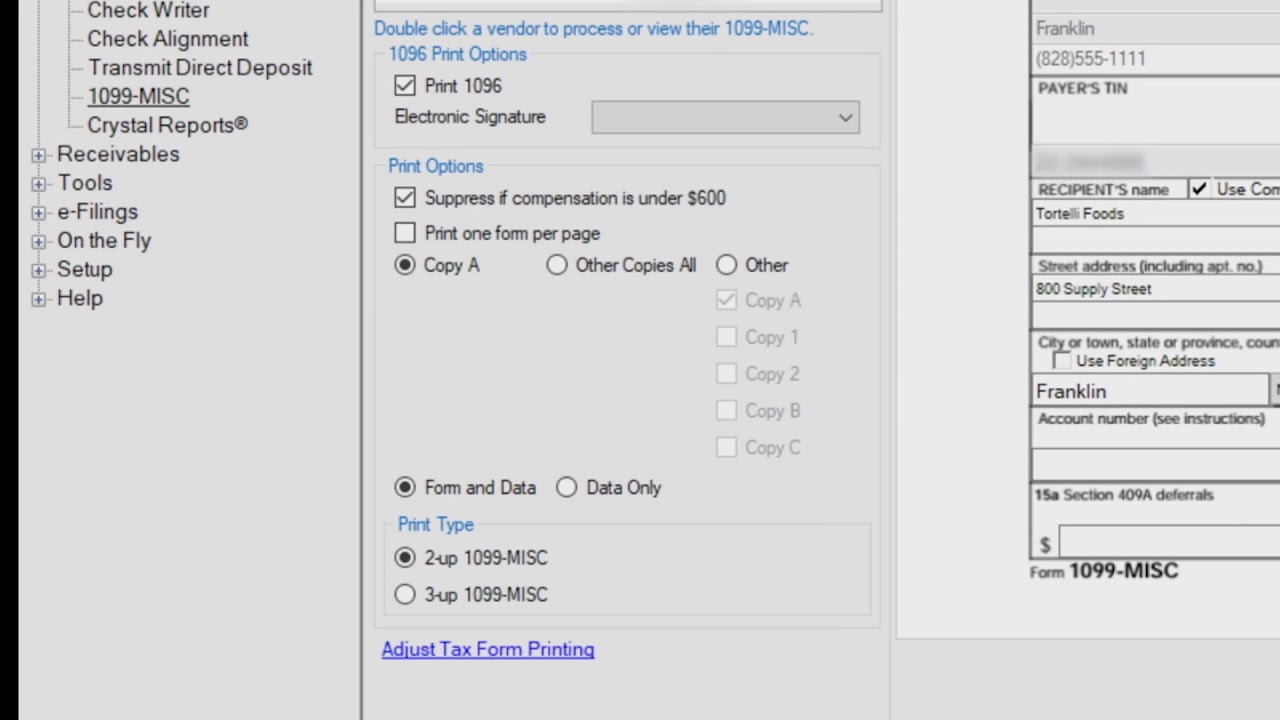

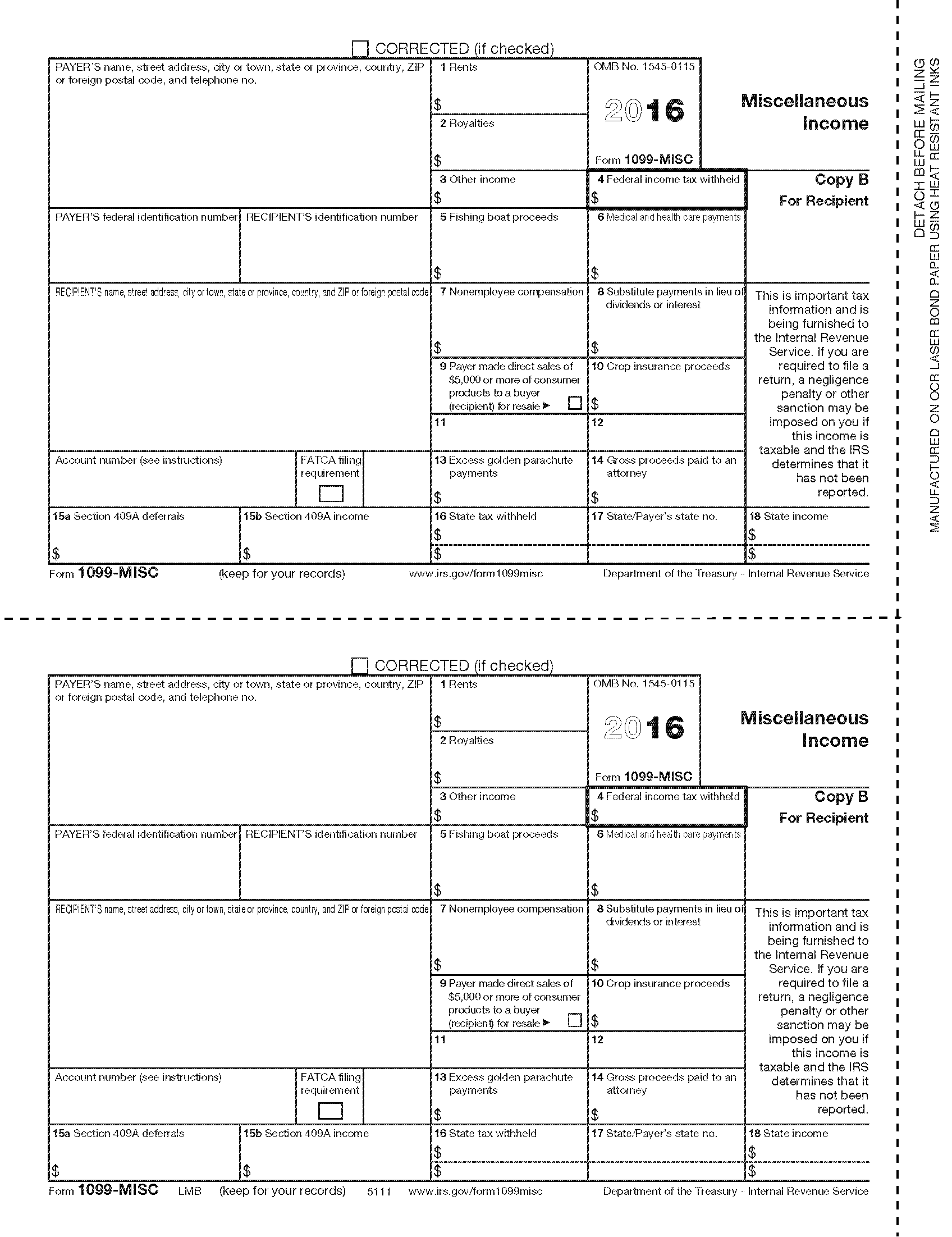

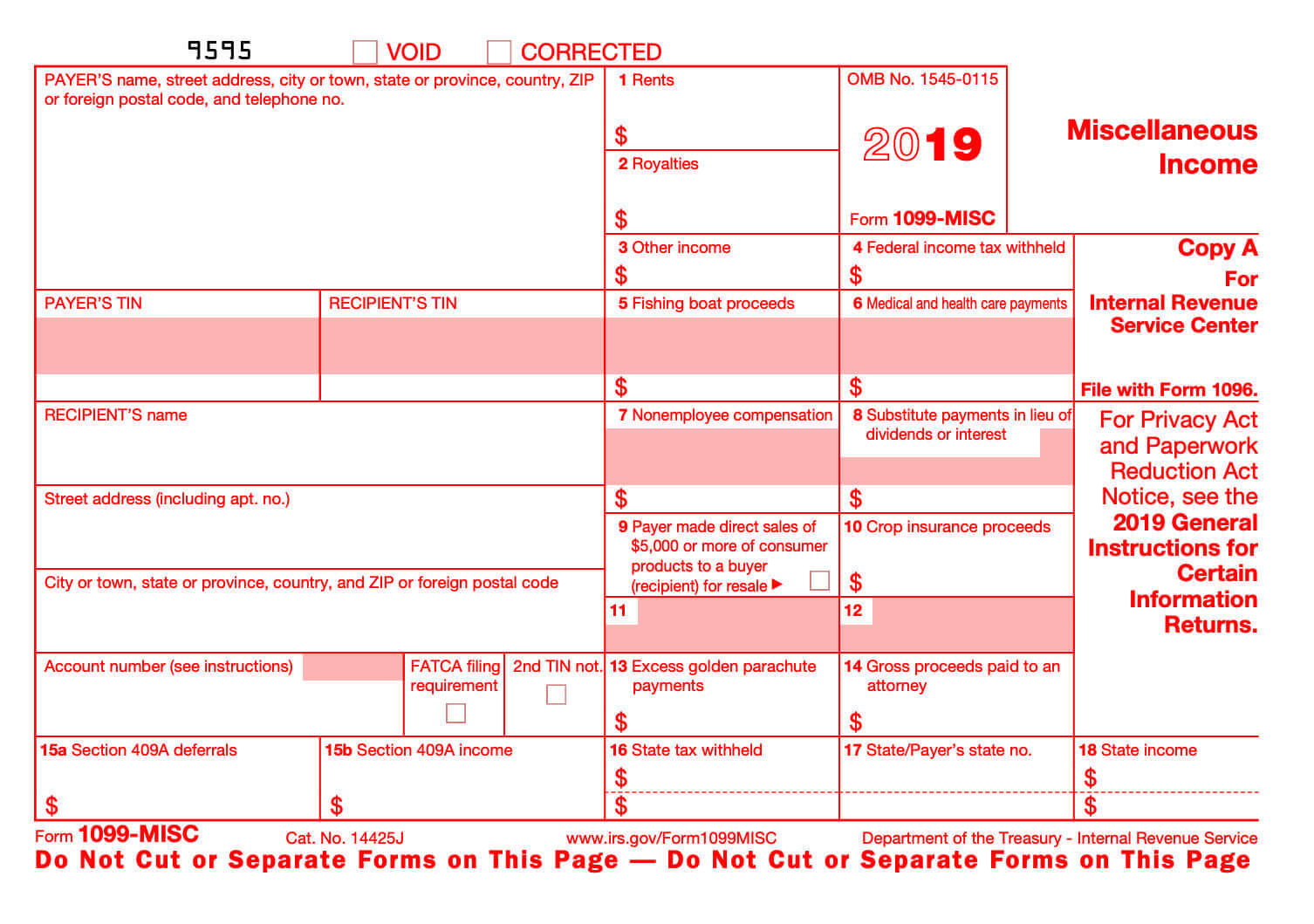

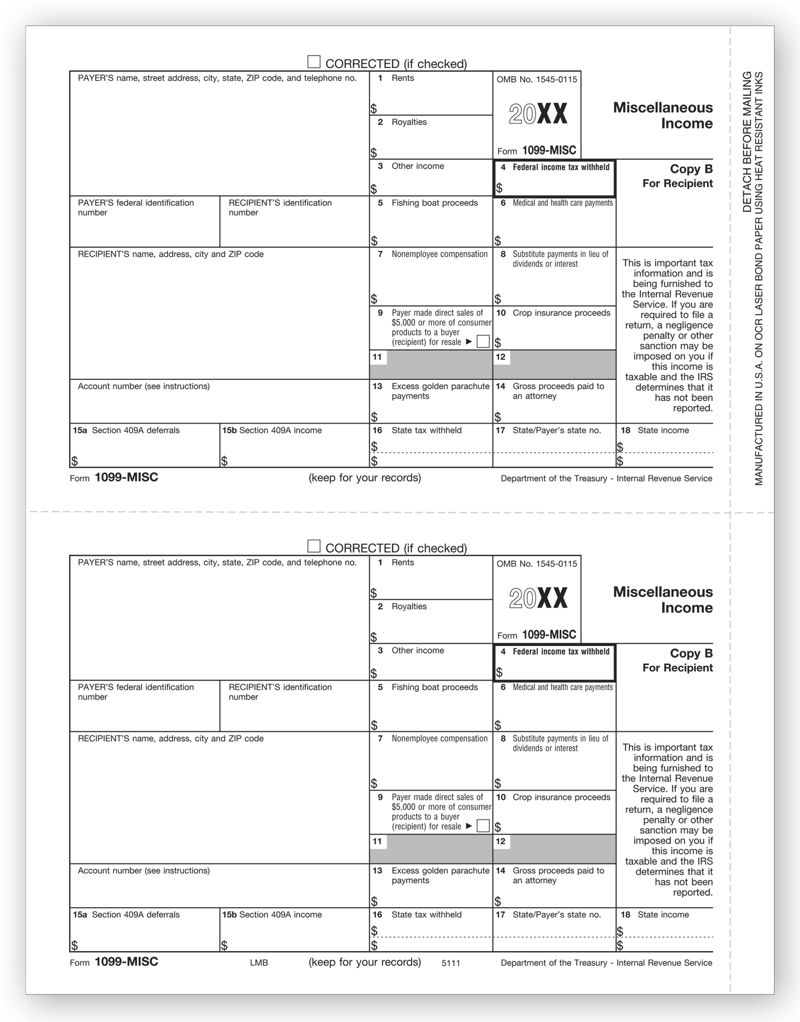

1099B Form Copy B Recipient 2up format 85″x 11″ with side perforation Printed on # laser paperUse Form 1099NEC Copy B to print and mail payment information to the recipient for submission with their federal tax return 1099NEC forms are printed in a 2up format Forms are 8 1/2" x 11" with no side perforation and are printed on # laser paper Order the quantity equal to the number of recipients for which you file, not the sheet1099MISC Form Copy B Recipient 1099 Miscellaneous Income Reporting of $600 **IMPORTANT CHANGES** If you use this form to report nonemployee compensation in Box 7, you MUST USE NEW 1099NEC FORMS in Learn more > If you file more than 100 forms, you MUST EFILE with the IRS in Our

Printable 1099 Forms Copy B Fill Online Printable Fillable Blank Pdffiller

1099 copy b form 2020

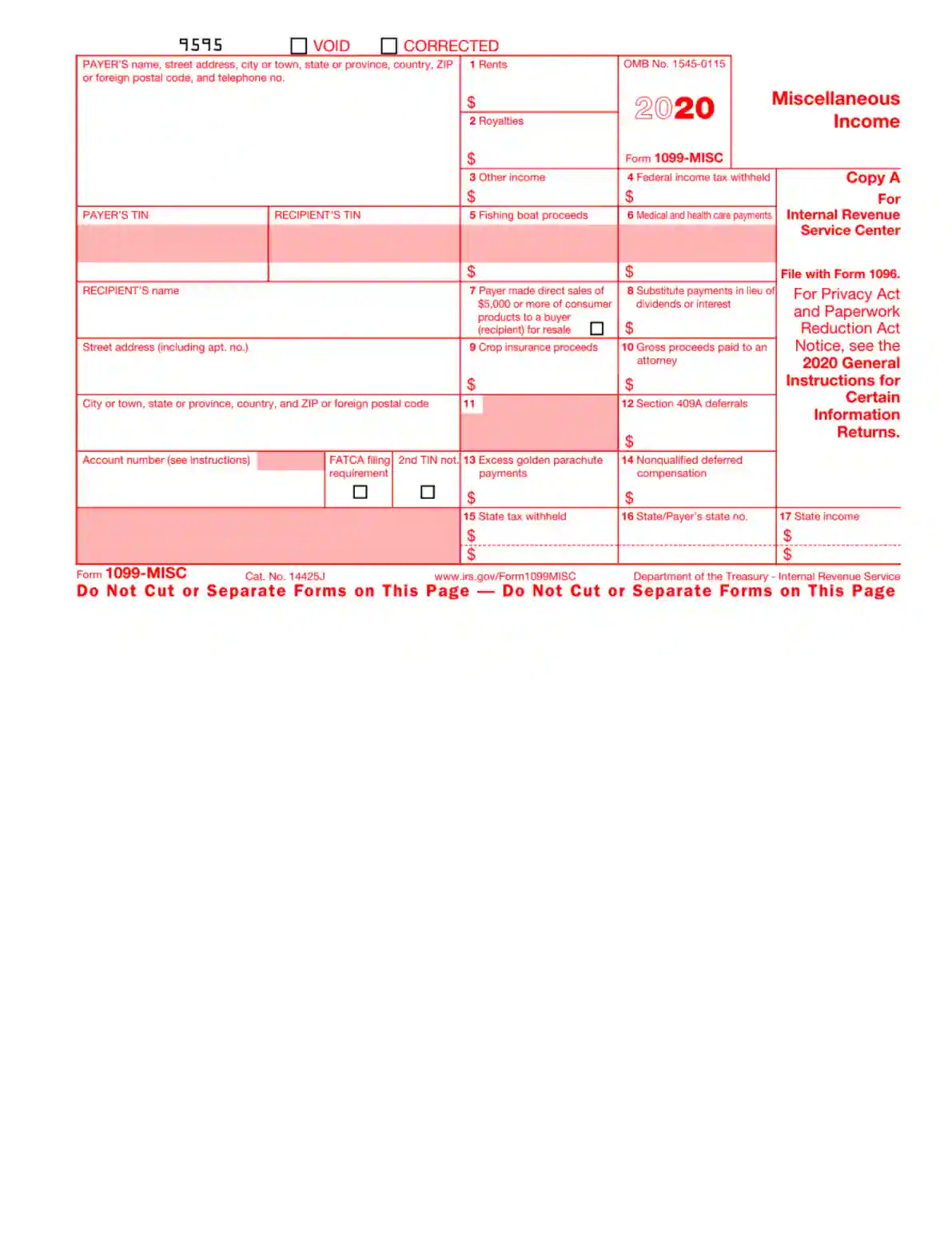

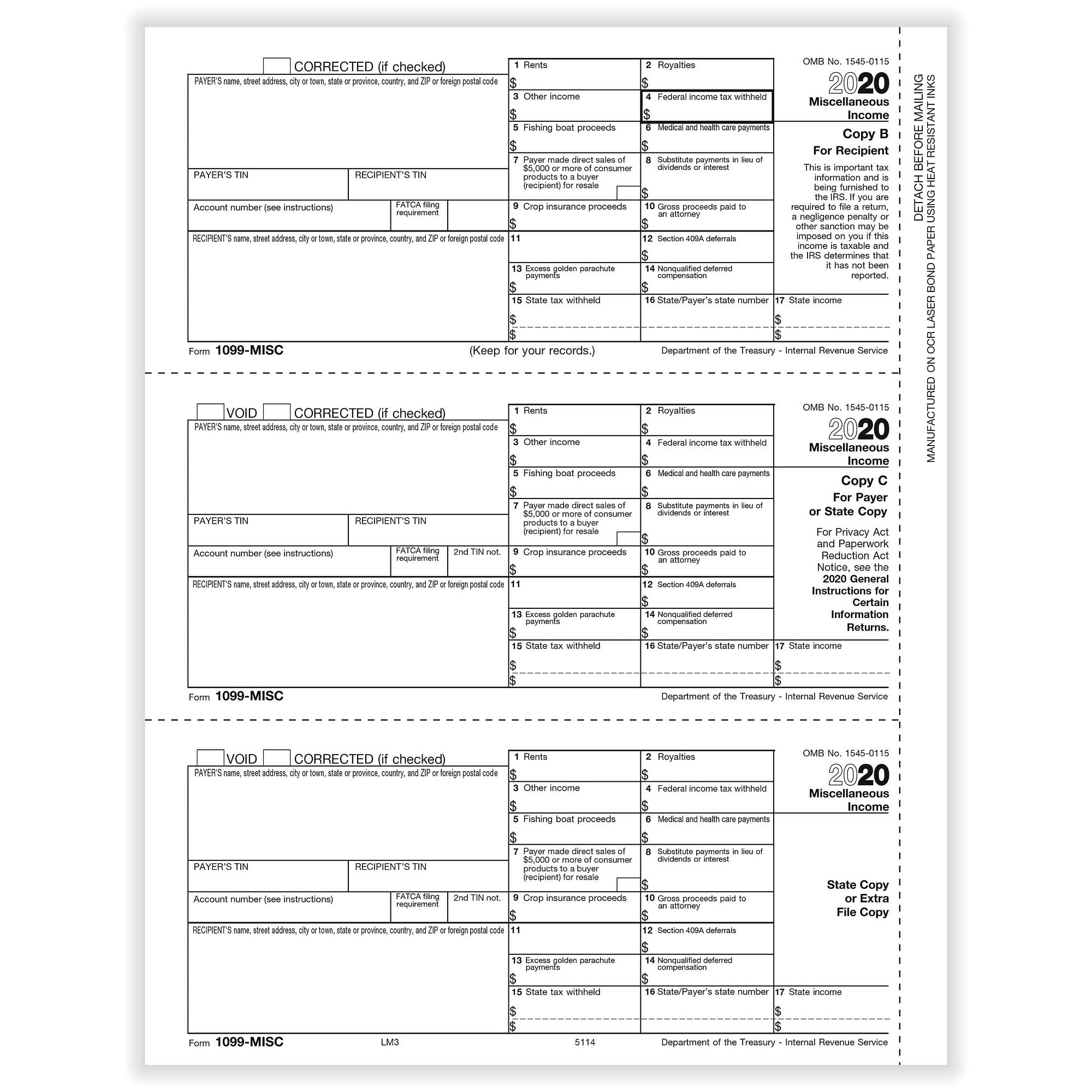

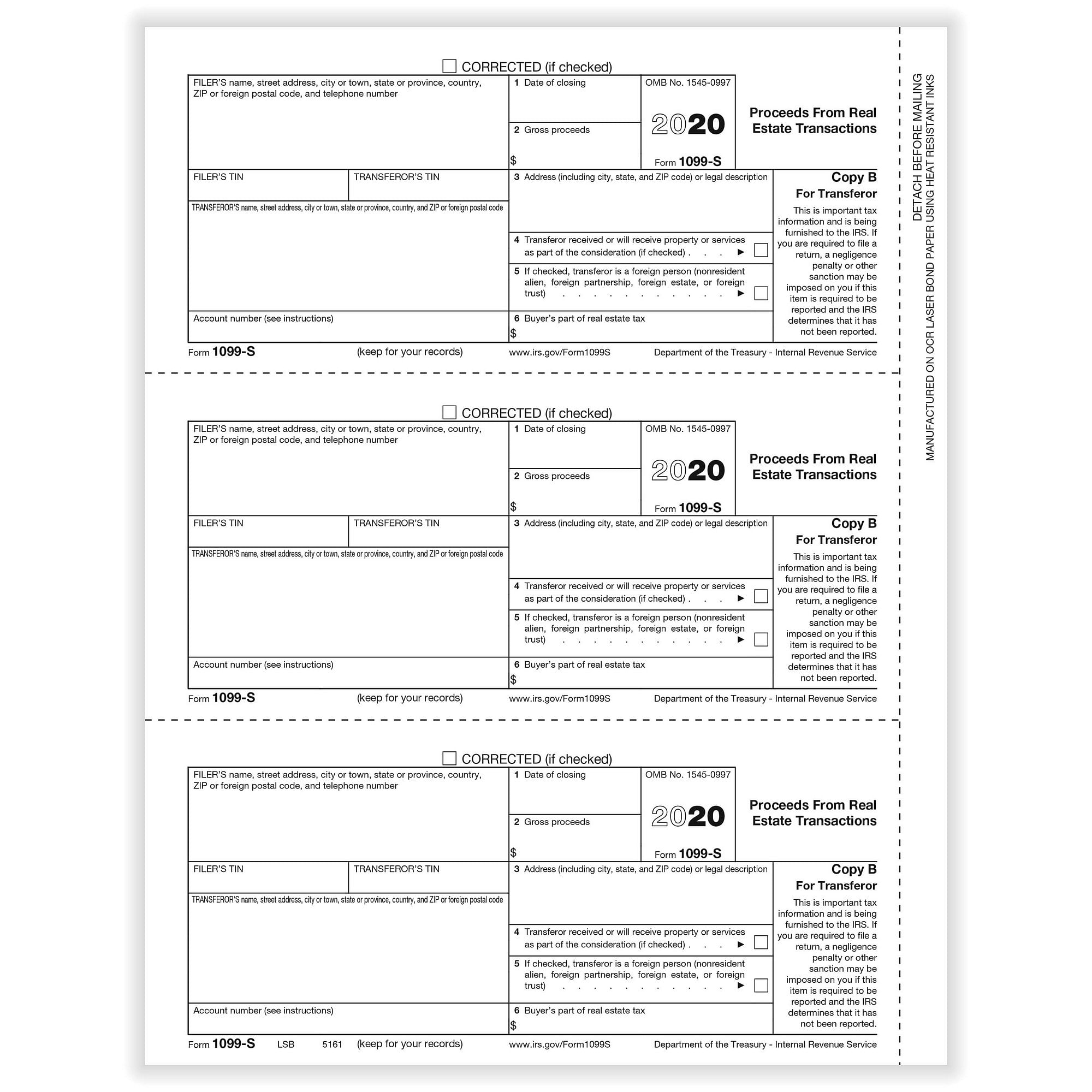

1099 copy b form 2020-Know the Different Copies of a 1099 Form For many employers, all five copies of the 1099 form are essential Copy A—Goes to the IRS Copy 1—Goes to the state tax agency Copy 2—Goes to the recipient Copy B—Goes to the recipient Copy C—Stays with employer for record keeping W2 1099 Forms Filer Pricing3 Submit CopyB to the Recipient Physical Submission On the completion of the 1099 MISC, a copy also needs to be sent to the recipient This is Copy B and should be sent across to the "nonemployee" before January 31 st Contrary to Copy A, Copy B can be downloaded and printed from the IRS' official website Online Submission

1099 Software User Guide Note This Is Intended To Be A General Guide To Introduce You To The Ftwilliam Com 1099 Software Features And Structure More Details Are Often Provided At Ftwilliam Com And Through Free Webinars Preformed Throughout The Year At

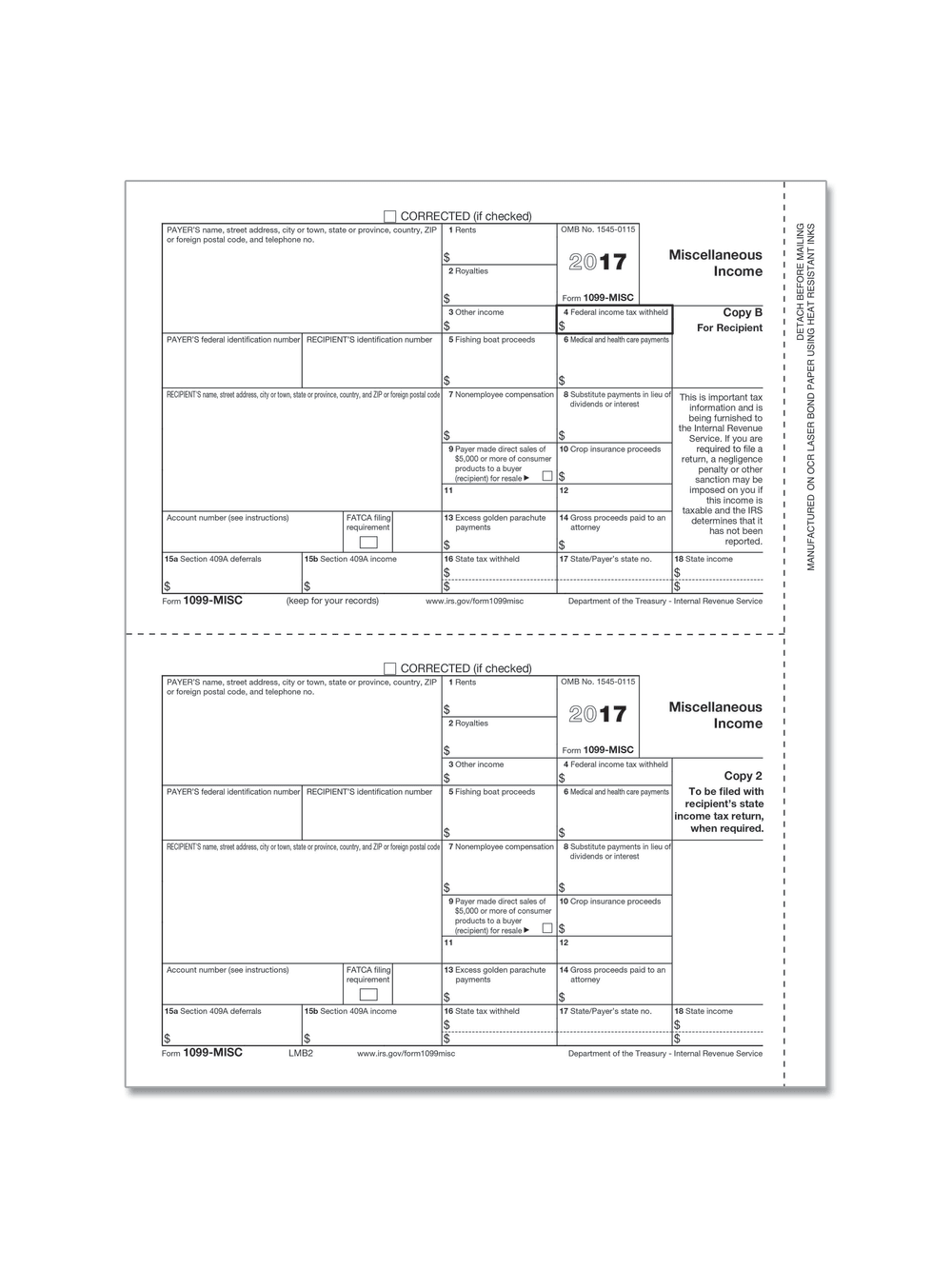

Data currently reported in Box 7 (Nonemployee compensation) of Form 1099MISC for tax year 19, will be required to be reported in Box 1 of Form 1099NEC for tax year Recipient Copy B For use with envelope DWMR or SWMR Can also use with selfseal envelope DWMRS 2Up format means one sheet covers 2 recipientsPreprinted 1099 Miscellaneous for Reporting Royalties, Prizes, or Commissions This form is in a 2up format on 8 1/2 by 11" paper Recipient copy B Please note that this IRS Approved 1099 Miscellaneous Income form, Recipient Copy B Classic 2 on a page forms for sending to the recipient of funds Order by the Case After June 1st Tax form is for current Tax year

Form 1099MISC Federal IRS Copy B Used to print and mail payment information to the recipient for submission with their federal tax return 2Print 1099 Misc Form For Recipient The Internal Revenue Service needs business to provide a form 1099 misc copy to any individual If businesses paid more than $600 per the calendar year to recipients for services rendered, businesses must send an IRS 1099 tax formForm 1099NEC (keep for your records) 2Mwwwirsgov/Form1099NECDepartment of the Treasury Internal Revenue Service Instructions for Recipient You must also complete Form 19 and attach it to your return If you are not an employee but the amount in

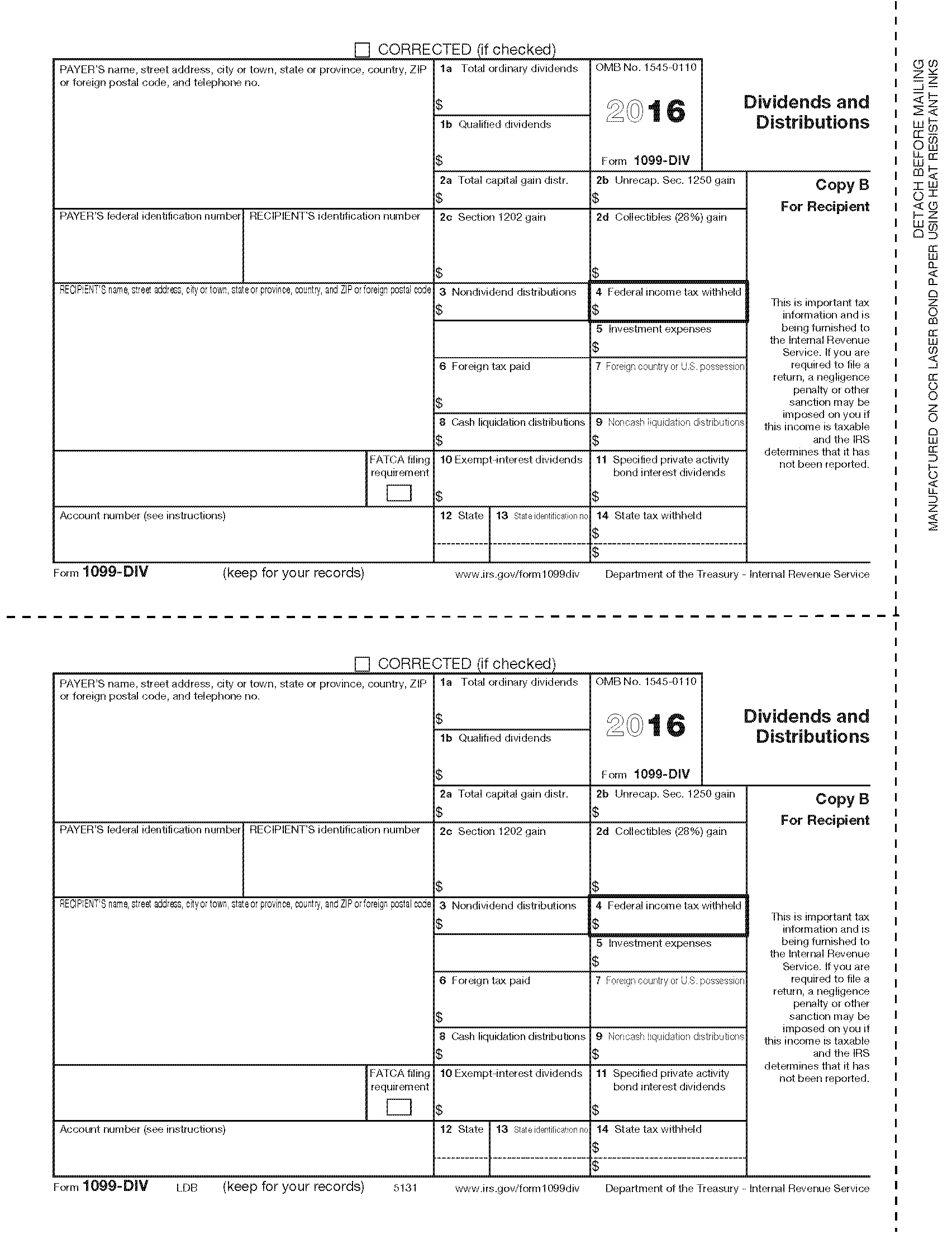

Read more on our blog Decoding 1099MISC Copy Requirements 3PART STATES AK, CA, FL, GA, IL, IN, IA, KY, LA, MD, MI, MO, NV, NH, NM, NY, OR, SD, TN, TX, VT, WA, WYBundle of 25 envelopes for 1099's that print 2 per page These include Forms 1099B, 1099DIV, 1099INT, 1099MISC, 1099OID, 1099R, and 5498 Each Item is a package of 25 envelopesPlease note that Copy B and other copies of this form, which appear in black, may be are considered a nominee recipient You must file Form 1099DIV (with a Form 1096) with the IRS for each of the other owners to show their share of the income, and you must furnish a Form 1099DIV to each A spouse is

Tax Form 1099 Div Copy B 2 Recipient 5131 Form Center

1099nec Tax Form Copy A For Federal Irs Filing Zbp Forms

1099MISC Form Copy A (2Up) For Internal Revenue Service See Image 1099MISC Form Copy B (2Up) For Recipient 1099MISC Form Copy C (2Up) For Payer 1099MISC Form Copy 1 (2Up) For State Tax Department 1099MISC Form Copy 2 (2Up) To be filed with recipient's state income tax return, when required 1099NEC Form Copy A (2Up) For IRSForm 1099MISC Federal IRS Copy B Used to print and mail payment information to the recipient for submission with their federal tax return 2NonEmployee CompensationUse Form 1099NEC Copy B to print and mail payment information to the recipient for submission with their federal tax return 1099NEC forms are printed in a 3up formatForms are 8 1/2" x 11" with no side perforation and are printed on # laser paper Mail recipient copies in compatible window envelopes

Form 1099 Div Recipient Copy B

1099 Misc Tax Form Pressure Seal W 2taxforms Com

Use Form 1099DIV Copy B to print and mail payment information to the recipient 1099DIV Forms are 2up on an 8 1/2 x 11" sheet with no side perforation and are printed on # laser paper Order the quantity equal to the number of recipients for which you file, not the sheet Mail recipient copies in compatible window envelopes1099MISC 2Up Individual Recipient Copy B • 2Up Copy B for Recipients' records • Laser cut sheets • Printed with heatresistant ink for use with most inkjet and laser printers • 1 page equals 2 forms • Comes in packs of 100 and 1000 forms • Compatible envelopes are L1312 and L0741Parts of 1099 MISC Forms Copy A Federal Copy for filing with the IRS Copy B Recipient Copy (Sent to Independent Contractor) Copy C Payer Copy (Retained by the Employer) Copy D/1/2 State and local filing (Depends on States Tax Rules)

Shop Page 3 Of 10 Forms Fulfillment

Http Www Pcsai Com W2 Helpful Info Page Pdf

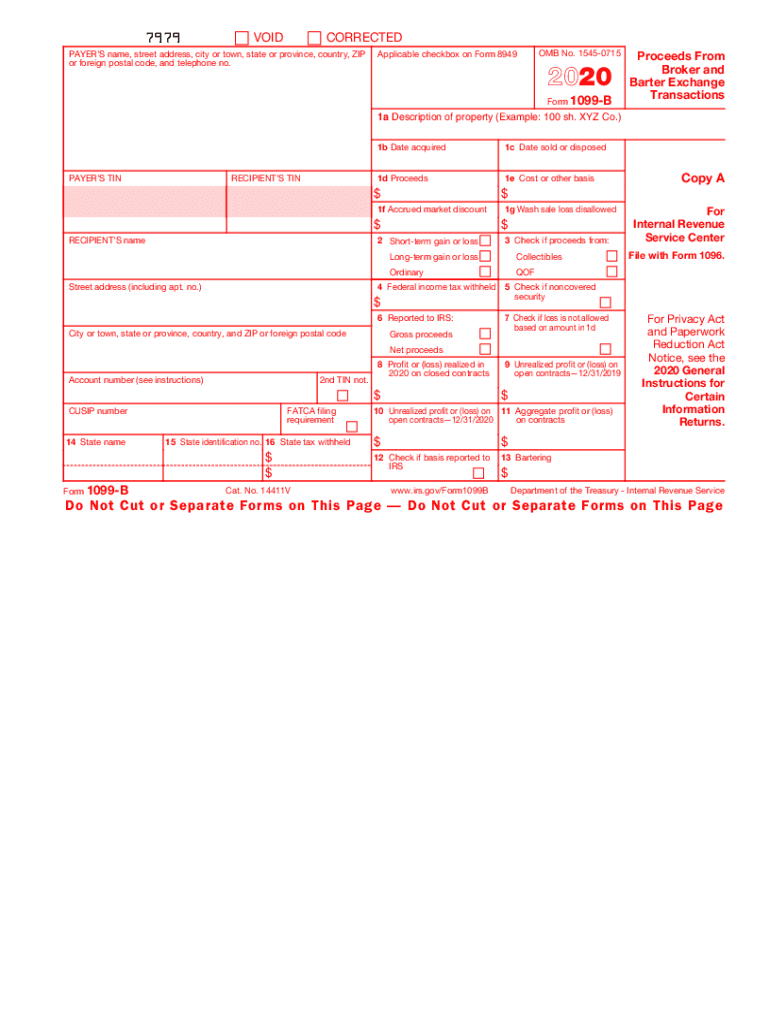

Instructions for Recipient Brokers and barter exchanges must report proceeds from (and in some cases, basis for) transactions to you and the IRS on Form 1099B Reporting is also required when your broker knows or has reason to know that a corporation in which you own stock has had a reportable change in control or capital structureForm 1099DIV Dividends and Distributions Copy B For Recipient Department of the Treasury Internal Revenue Service This is important tax information and is being furnished to the IRS If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determinesCopy C Payer Copy;

How To File Form 1099 Nec For Contractors You Employ Vacationlord

1

State and Federal Tax Forms When preparing and sending 1099s, make sure that all the required documents are included One part of the form is Copy B, which is designated for the recipient to keep on file Tax preparers will often pull this part and set it aside as they focus on the copies designated for the IRSLaser 1099NEC 3up Recipient Copy B #NECLMB $ 000 – $ 2900 Laser 1099NEC 3up Recipient Copy B #NECLMB Please note that this form is for the current tax yearTax Filing for NonEmployee Compensation Easily report payments other than wages, tips and salaries, such as miscellaneous income, to nonemployees made in the course of a trade or business with 1099NEC forms The 1099 NEC Recipient Copy B

Fbs Systems Forms Checks Tax Forms And Envelopes

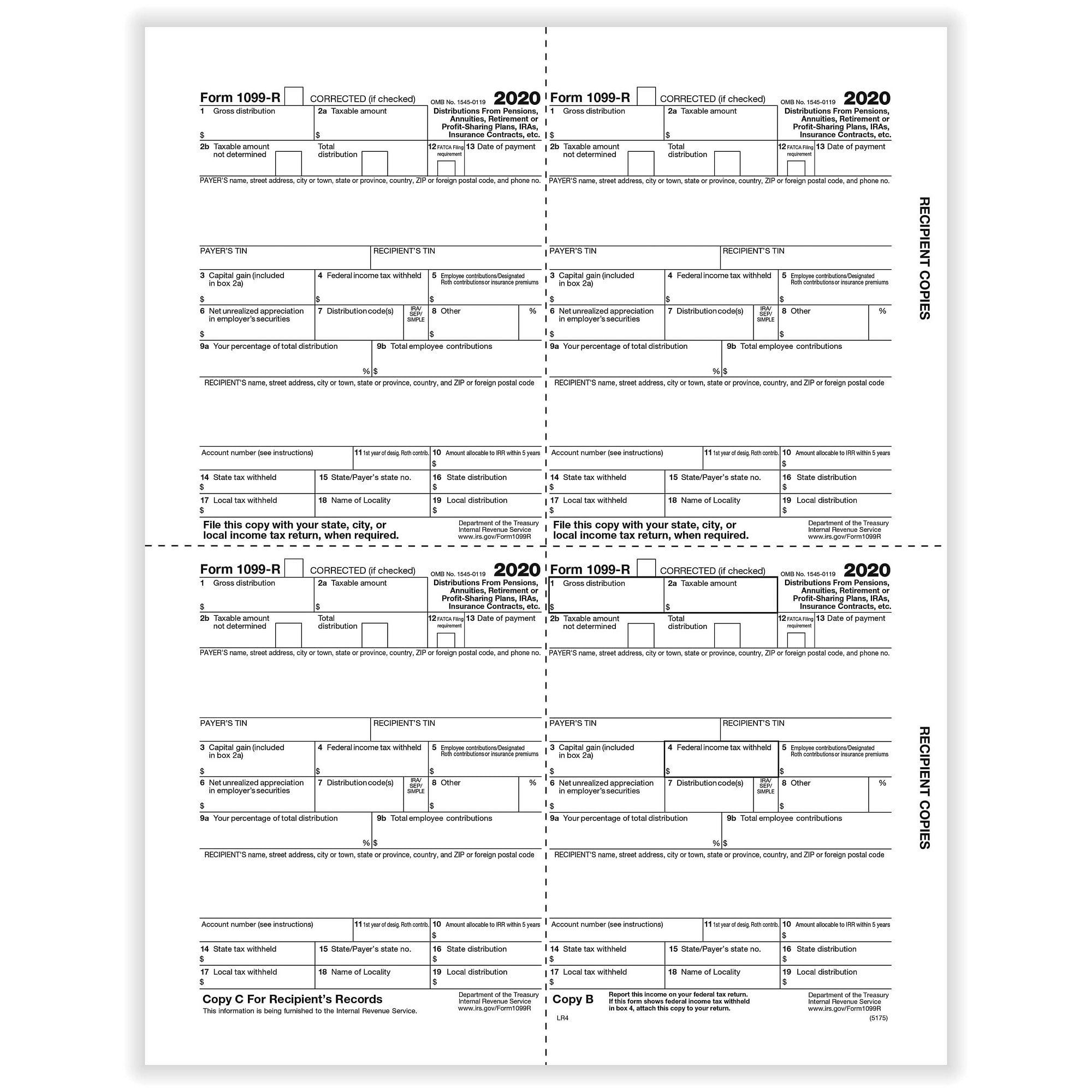

Tax Form 1099 R Copy B Recipient Condensed 4up 5175 Mines Press

Please note To determine whether you need to use 1099MISC forms or the new 1099NEC forms introduced in , please click the links to watch this video or download this PDF file Recipient Copy B, to send to recipient Compatible with QuickBooks and most major accounting programs For laser or inkjet printers Copy B, for Recipient's recordsLaser 1099MISC Income, Recipient Copy B Use to Report Miscellaneous payments Compatible with laser or inkjet printers Government approved # bond paper Two forms per sheet of each copy For 24 RecipientsUse the 1099MISC Recipient Copy B to print and mail payment information to the recipient (payee) for submission with their federal tax return

100 Pk Recipient Copy B 19 Laser 1099 Misc Tax Forms Human Resources Forms Forms Recordkeeping Money Handling Btsmakina Com

Printable 1099 Forms Copy B Fill Online Printable Fillable Blank Pdffiller

Copy 2 State and Local Copies;1099B Form Copy B Recipient 2up format 85″x 11″ with side perforation Printed on # laser paper No Copy 2 of 1099MISC?

How To Read Your 1099 Robinhood

1099 Nec Pressure Seal Forms Copy B 2 2up 11 Z Fold Discount Tax Forms

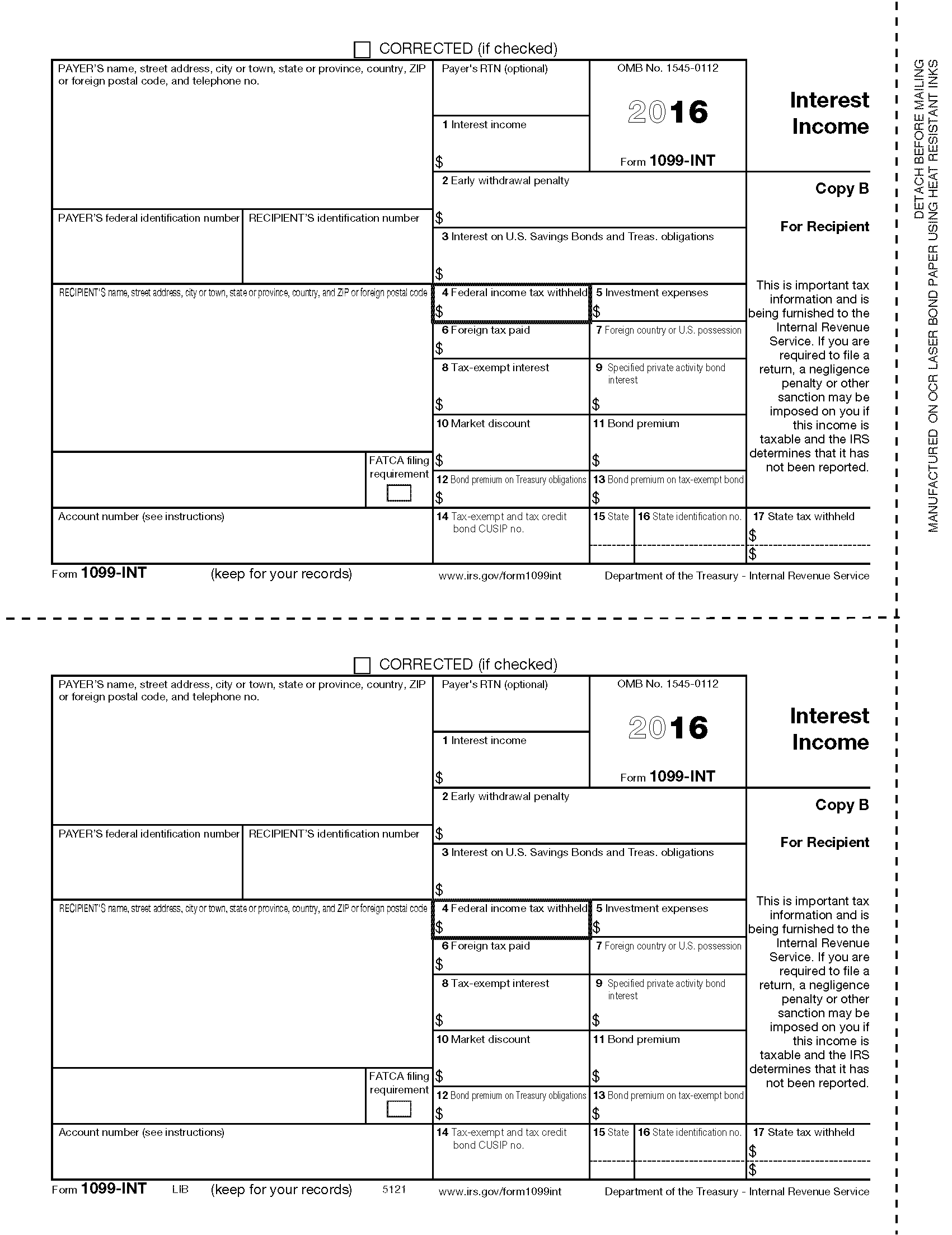

Use Form 1099INT to report interest of $1000 or more, taxable or nontaxable, and to report any federal or foreign income tax withheld and not refunded, paid in the course of your trade or business Mail this copy to the Recipient using the 1099RENV envelope 2 Forms per page Price is for a package of 25 pages = 50 Recipients Copy B for the recipient The information on a 1099MISC form is in two parts Information about the payer and the payee, including taxpayer ID numbers for bothTurbo Tax doesn't give copy 2 The person really doesn't need to send the state a copy They don't even attach copy B for the IRS if mailing their return If they need another copy for state or someone they can just make a copy of B Turbo Tax doesn't provide copy A either

S1 Q4cdn Com Files Doc Downloads Forms 21 Us Tax Guide Pdf

Office Depot

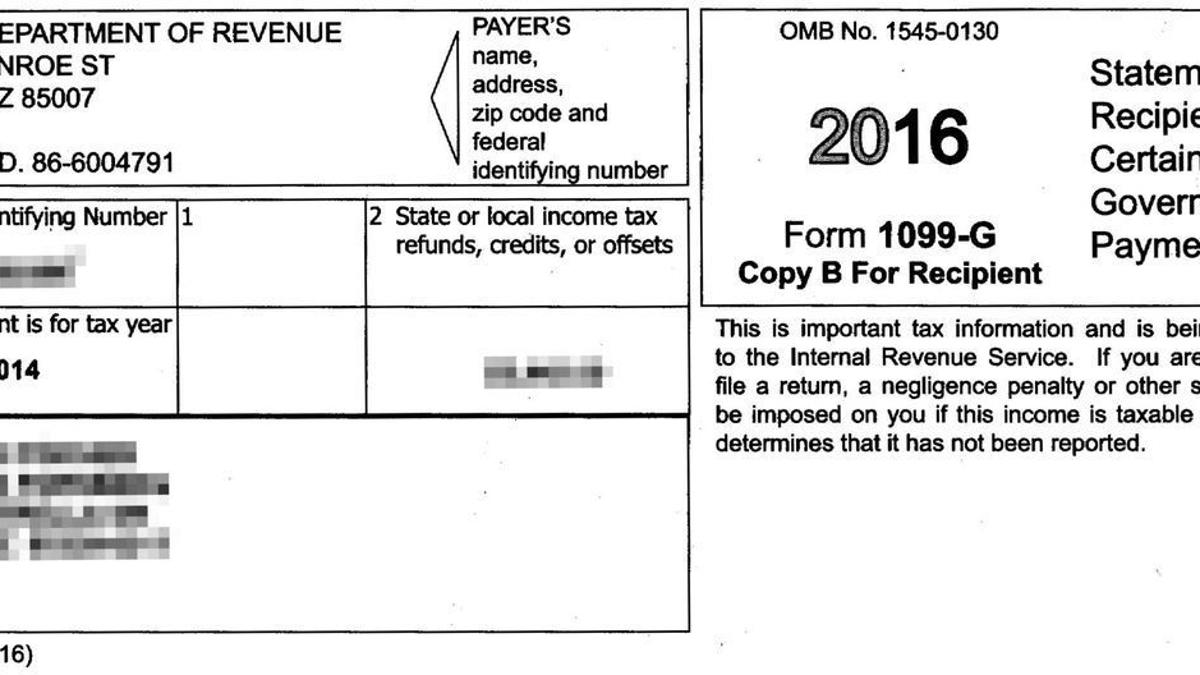

Recipient Copy B, for the Recipient (Payee) to file with the IRS Forms are 2up on an 8 1/2" x 11" sheet with a 1/2" side perforation Order by number of recipients, not by sheetsCOPY B FOR RECIPIENT FORM 1099G CERTAIN GOVERNMENT PAYMENTS REPORT OF TAXABLE UNEMPLOYMENT COMPENSATION PAYMENTS FROM THE STATE OF CALIFORNIA OMB NO Form 1099G Rev 37 Employment Development Department Recipient's Name Unemployment Insurance Integrity and Accounting Division MIC 16A PO Box2408 Rancho1099NEC 2Up Individual Recipient Copy B • 2Up Copy B for Recipients' records • Laser cut sheets • Printed with heatresistant ink for use with most inkjet and laser printers • 1 page equals 2 forms • Comes in pack sizes of 100 and 1000 • Compatible

1099 R Retirement Recipients Copy B C And 2 File Copies 4 Up Box Format Cut Sheet 500 Forms Ctn

18 Recipient 24 Recipients 1099 Misc Laser Copy B Income Office Supplies Forms Recordkeeping Money Handling

1099, 3921, or 5498 that you print from the IRS website Due dates Furnish Copy B of this form to the recipient by File Copy A of this form with the IRS by To file electronically, you must have software that generates a file1099‐MISC Copy B For the Recipient 1099‐MISC Copy 2 For the Recipient (to file with their state returns) 1099‐MISC Copy C For the Payer (the Chapter's copy) Completed W‐9 Forms from independent contractors, partnerships, S Corporations or LLCs being paid for work performed Note Form 1096 and all 1099‐MISC copies (A,B,2,C) areThe number of 1099 pars needed is based on government filing requirements Copy A Federal Copy for the IRS;

1099 Nec Form Copy B 2 Zbp Forms

Index Of Forms

If you file through snail mail, you must mail Form 1096 and Copy A of each Form 1099 to the IRS For the recipient, you have to send Copy B and Copy 2 You can purchase the preprinted forms at your local stationery stores like StaplesCountry, ZIP or foreign postal code, and telephone no 1 Rents NAME OF OWNER, CORP LLC WASHINGTON NAILS 1234 SUNSET BLVD WESTMINSTER, CA 926 $ OMB No $ Form 3 Other income 1099MISC Copy B 4 Federal income tax withheld $ Miscellaneous Income 14 2 Royalties $ For Recipient 30 PAYER'S Federal identification number RECIPIENT'S1099 DIV Copy B For Recipient 1099 DIV Copy C For Payer All these copies can be printed on blank paper with black ink Support for these copies requires W2 Mate Option #5 Prints the following 1099R (Distributions From Pensions, Annuities etc) copies 1099R Copy B To be filed with recipient's federal tax income tax return, when required

Instant Form 1099 Generator Create 1099 Easily Form Pros

Brb05 Form 1099 R Distributions From Pensions Etc Copy B Recipient

Therefore, the signNow web application is a musthave for completing and signing form 1099 g copy b on the go In a matter of seconds, receive an electronic document with a legallybinding esignature Get 17 fillable 1099 g signed right from your smartphone using these six tips Type signnowcom in your phone's browser and log in to your8 Description, 1d Stock or Other Symbol, CUSIP (IRS Form 1099B box numbers are shown below in bold type) FORM 1099B* Proceeds from Broker and Barter Exchange Transactions Copy B for Recipient OMB NO Longterm transactions for which basis is not reported to the IRS Report on Form 49 with Box E checked and/or Schedule D, Part II 1099 INT Copy B For Recipient 1099 INT Copy C For Payer All these copies could be printed on clean paper with black ink Help for these copies requires W2 Mate Possibility #5 Prints the next 1099DIV (Dividends and Distributions) copies 1099 DIV Copy B For Recipient 1099 DIV Copy C For Payer

Q Tbn And9gcr A0xynxdhhxxfl7nxp1 Ksov2b3i1bqvj6yqi0itop9kghngk Usqp Cau

1099 Int Interest 2 Up Recipient Copy B Creative Document Solutions Llc

Copy B is sent to the payee Here we provide tips on preparing Copy B statements to recipients or payees There is no time extension for distributing Copy B Copy B must be sent to the payee on time Postmark the letter on or before the due date You can also email, fax or just print out Copy B and hand it to the payeeSize 8 1/2" x 11" Form 1099NEC Format 2 up Classic Copies Copy B Ink Color Black Perforation Vertical at 1/2" from Right, 5 1/2 from bottom Product Information The PATH Act, PL , Div Q, sec 1, accelerated the due date for filing Form 1099 that includes nonemployee compensation (NEC) from February 28 to January 31 andCopy B Recipient Copy;

Will I Receive A 1099 Nec 1099 Misc Form Support

1099 Int Laser Recipient Copy B

Remember our site has already mailed this copy to your recipients, however if a recipient loses his or her copy, you can print a replacement copy from the Filed Forms page 1099DIV – Copy B and Copy 2Miscellaneous InformationUse Form 1099MISC Copy B to print and mail payment information to the recipient for submission with their federal tax return 1099MISC forms are printed in a 2up format Forms are 8 1/2" x 11" with no side perforation and are printed on # laser paper Mail recipient copies in compatible window envelopes

1099 Nec 4 Part Tax Form Kit

Irs Form 1099 Misc Fill Out Printable Pdf Forms Online

1099 Misc Miscellaneous Rec Copy B Payer State Copy C State Extra File Copy 500 Forms Ctn

Boidrec05 Form 1099 Oid Original Issue Discount Copy B Recipient Nelcosolutions Com

1099 Interest Tax Form Pressure Seal Copy B W 2taxforms Com

What Is Form 1099 Nec Business Quick Magazine

1099 G Fill And Sign Printable Template Online Us Legal Forms

Q Tbn And9gcr A0xynxdhhxxfl7nxp1 Ksov2b3i1bqvj6yqi0itop9kghngk Usqp Cau

1099 S Proceeds From Real Estate Transactions Transferor Copy B Cut Sheet 500 Forms Pack

How To Fill Out And Print 1099 Nec Forms

Bintfed05 1099 Int 2up Federal Copy A Greatland Com

Form 1099 Misc Requirements Deadlines And Penalties Efile360

1099 Misc Form Copy C 2 Payer State Discount Tax Forms

1099 Misc Recipient Copy B Packs Of 50 Lmb Print Promo Plus Business Solutions Services Supplies

1099 S Transferor Copy B For 50 Recipients Forms Recordkeeping Money Handling Office Supplies Ekoios Vn

Using The G L Method

1099 Nec A New Way To Report Non Employee Compensation Hlb Gross Collins

Time To Send Out 1099s What To Know

Form 1099 Int Irs Copy A

1099 Int Recipient Copy B

Form Irs 1099 B Fill Online Printable Fillable Blank Pdffiller

1099 Nec Form Copy B C 2 3up Zbp Forms

1099 Nec Form Copy B Recipient Zbp Forms

Ints305 1099 Int Interest Income Preprinted Set 3 Part Greatland Com

1099 Software User Guide Note This Is Intended To Be A General Guide To Introduce You To The Ftwilliam Com 1099 Software Features And Structure More Details Are Often Provided At Ftwilliam Com And Through Free Webinars Preformed Throughout The Year At

1099 Misc Form 1099 Tax Form Printable 1099 Form

1099 Misc Form Copy B Recipient Discount Tax Forms

1099 K Tax Form Copy B Laser W 2taxforms Com

Shop Page 3 Of 10 Forms Fulfillment

E Filing 1099s Youtube

1099 Misc Form Copy B Recipient Zbp Forms

580 000 In Arizona Receive Incorrect Tax Form Local Azdailysun Com

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Blue Summit Supplies Tax Forms 1099 Misc 4 Part Tax Forms Bundle

2

Tax Forms 100 Pk Recipient Copy B 19 Laser 1099 Misc Tax Forms Office Products

/ScreenShot2020-02-03at11.15.35AM-a3c24d655e9748e19bab699b55c1b7b6.png)

Form 1099 Div Dividends And Distributions Definition

F 1099 Misc

11 Pressure Seal 1099 Misc Form Z Fold Recipient Copies B 2 Nelcosolutions Com

Form 1099 R Wikipedia

Tax Form 1099 Misc Copy B Recipient 5111 Form Center

Illinois Unemployment If You Got A 1099 G Tax Form From Ides Without Filing For Benefits You May Be Victim Of Fraud Abc7 Chicago

1099 Laser Misc Recipient Copy B Item 5111

1099 Misc Laser Recipients Copy B

1099 Patr Laser Recipient Copy B Item 5167

Tax Form 1099 Int Copy B 2 Recipient 5121 Mines Press

Form 1099 Nec Requirements Deadlines And Penalties Efile360

What Is Form 1099 Nec Who Uses It What To Include More

19 Laser 1099 Interest Tax Forms 100 Pk Recipient Copy B Tax Forms

1099 Misc Form Fillable Printable Download Free Instructions

Form 1099 B Interest Income Recipient Copy B

1099 Misc Recipient Copy B Forms Fulfillment

Recipient Copy B Egp Irs Approved 1099 G Laser Tax Form Government Payments Quantity 100 Recipients Tax Forms

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Www Irs Gov Pub Irs Pdf F1099msc Pdf

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements Hw Co Cpas Advisors

1099 Nec Form Copy B Recipient Discount Tax Forms

Form 1099 Nec Instructions And Tax Reporting Guide

1099 Nec Form Copy B C 2 Recipient Payer Discount Tax Forms

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.15.35AM-a3c24d655e9748e19bab699b55c1b7b6.png)

Form 1099 Div Dividends And Distributions Definition

Form 1099 Nec Instructions And Tax Reporting Guide

1099 Nec Recipient Copy B Cut Sheet Hrdirect

Amazon Com 50 1099 Misc And 1099 Nec Tax Envelopes Designed For Printed 1099 Laser Forms From Quickbooks Or Similar Tax Software 5 5 8 Inch X 9 Inch Gummed Flap 50 Form Envelopes Office Products

1

What Are Information Returns Irs 1099 Tax Form Types Variants

Form 1099 Misc Miscellaneous Income Recipient Copy B

Amazon Com 1099 Misc Forms 4 Part Laser Tax Forms 50 Vendors Kit With Self Seal Envelopes Federal State Copies 1096 S Great For Quickbooks And Accounting Software 1099 Misc Office Products

1099 Misc Miscellaneous 2 Up Recipient Copy B Creative Document Solutions Llc

Taxcalcusa 1099 1099 Nec And 1099 Misc Tax Forms

Alere Checks Checks Tax Forms And Envelopes

21 Laser 1099 Misc Income Recipient Copy B Deluxe Com

/1099-misc-form-non-employee-income-398362_updated_HL-c7c12d946b8f47689f520bc37e4efca8.png)

Form 1099 Misc What Is It

1099 Misc Software 2 Efile 449 Outsource 1099 Misc Software

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 B Tax Form Copy B Laser W 2taxforms Com

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)

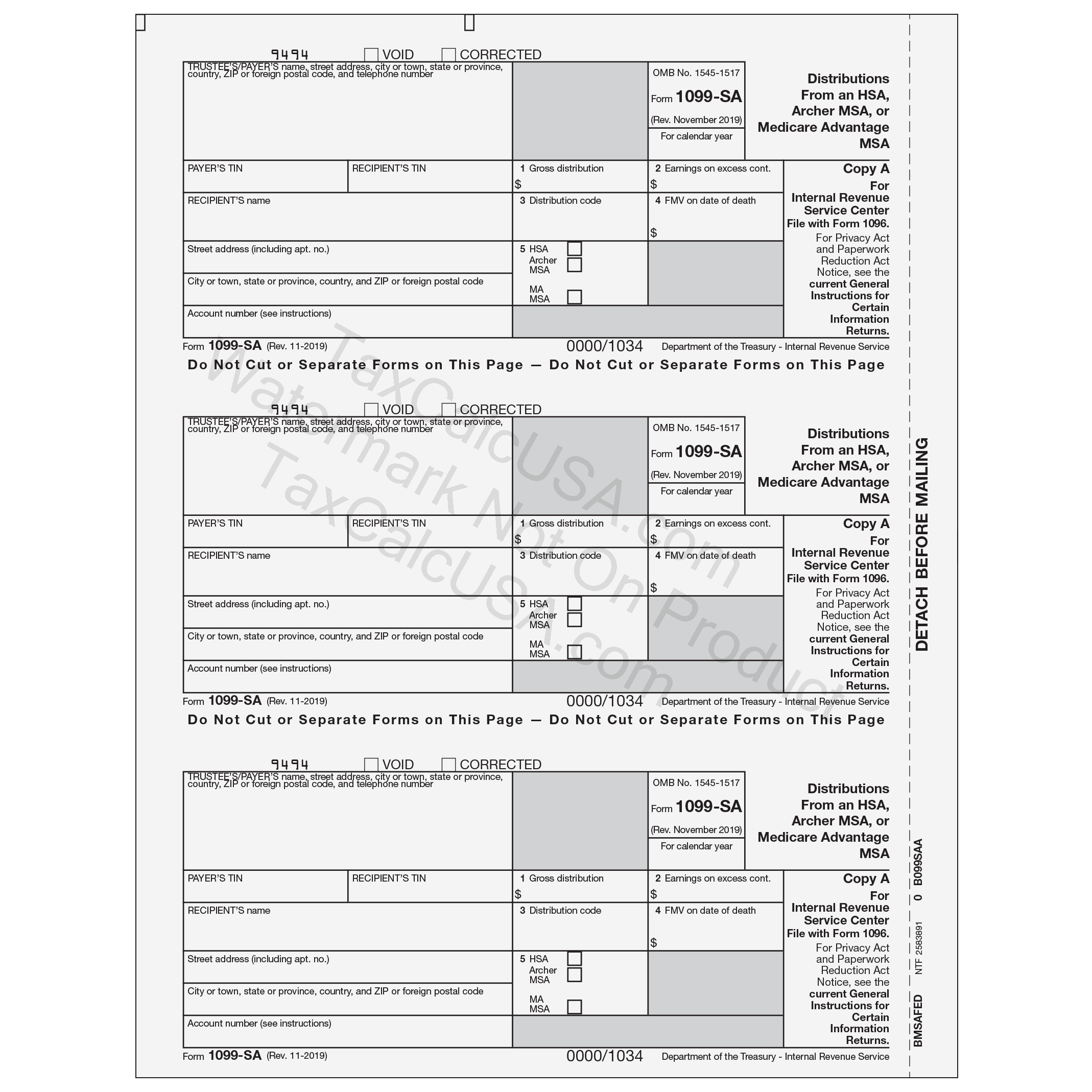

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Verticalive Forms

Using The G L Method

0 件のコメント:

コメントを投稿